Commodities Update - Week Ending 12 March 2022

Capitulation of the Old World Order

India is Considering Rupee Payments for Trade With Russia

India is working out a mechanism to facilitate trade with Russia using local currencies, with a decision expected as early as next week, according to people familiar with the matter.

Latest data show India’s bilateral trade with Russia stood at $10.8 billion, accounting for less than 1.5% of the South Asian nation’s total. International sanctions and financial restrictions on Russia after its invasion of Ukraine are disrupting supply chains and driving up commodities prices, which add to the inflation problems of developing economies such as India.

Analysis: While this appears to be a measure to soften the sanctions’ blows, we will be paying attention to how this situation will evolve going forward, even past the eventual resolution of the Russia-Ukraine crisis. History has shown us that wars have preceded the changing of world orders. The current US-centric world order is currently being challenged by the Dragon in the East. India is considered a close ally of the US so we will keep an eye on the possibility of the shifting of India’s alliance (however unlikely it may seem) towards Russia x China.

China Considers Buying Stakes in Russian Energy, Commodity Firms

China is considering buying or increasing stakes in Russian energy and commodities companies, such as gas giant Gazprom PJSC and aluminum producer United Co. Rusal International PJSC, according to people familiar with the matter.

Any deal would be to bolster China’s imports as it intensifies its focus on energy and food security -- not as a show of support for Russia’s invasion in Ukraine -- the people said. The discussions are at an early stage and won’t necessarily lead to a deal.

Analysis: Should the deals go through, this will be a necessary chess piece for China’s pursuit of hegemony in the east by reducing its dependency on the USD-centric energy trade.

Eastern Europe Emergency

Oil Settles Up but Posts Biggest Weekly Decline since Nov

Oil prices settled higher on Friday but posted their steepest weekly decline since November, as traders assessed potential improvements to the supply outlook that has been disrupted by Russia's invasion of Ukraine.

Urals still failed to catch a bid versus Brent with Asian buyers shunning Russian oil despite ‘incredibly’ cheap prices.

Here is a quick summary of what has happened concerning Russia this week:

Bullish Oil

U.S. imposes new sanctions on Russia

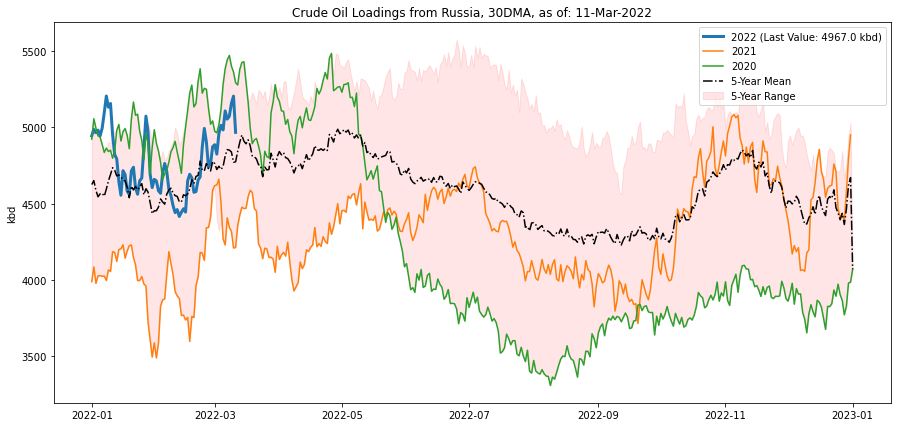

Note that Russian crude imports into the US (anywhere between 100-300kbd) make up a small proportion of the US’s total crude imports (~3000 kbd). Russian crude oil loadings remained rather brisk.

In response to sanctions, Russia has threatened to cut natural gas flows to Europe via Nord Stream 1. Engie chief executive Catherine MacGregor said on Monday that any decision to stop Russian energy imports in retaliation for Russia's invasion of Ukraine would impact the energy supplies of France and Europe next winter.

Iran talks pause

Iran and the United States were at loggerheads over reviving the 2015 nuclear deal on Thursday after Tehran suggested there were new obstacles and Washington said hard issues remained.

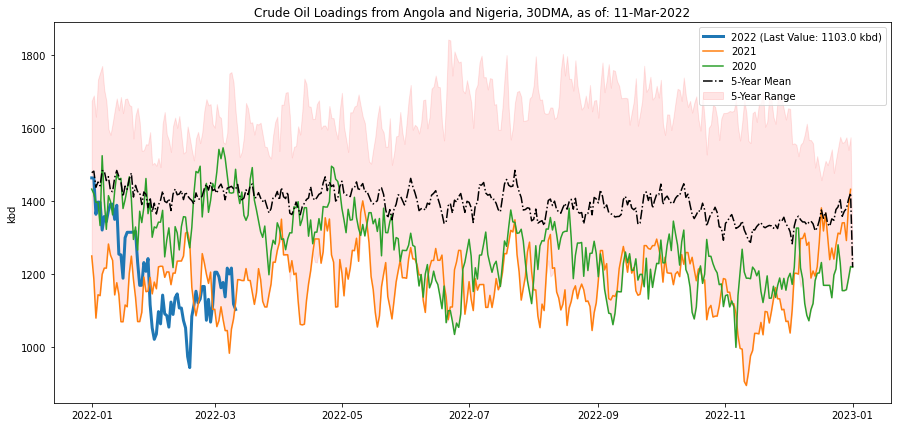

Some OPEC+ producers, including Angola and Nigeria, have struggled to meet production targets, limiting the group's ability to offset Russian supply losses.

Bearish Oil

Both IEA and OPEC have indicated the market should be oversupplied this year.

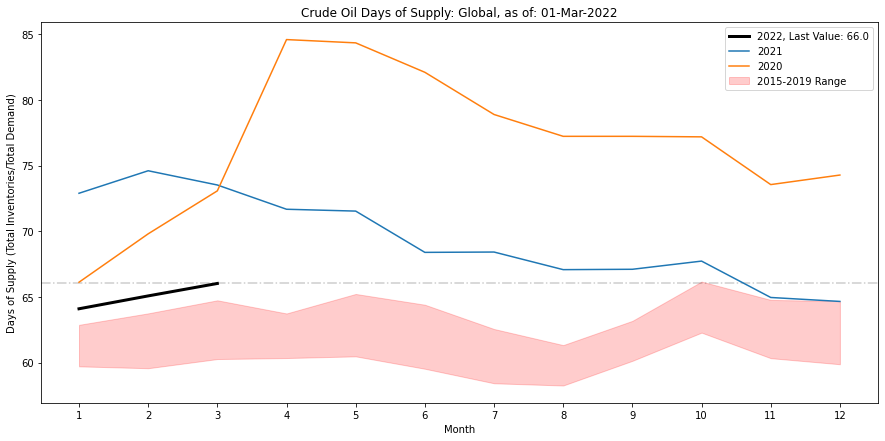

Global days of supply for crude oil remained above seasonal highs for March.

U.S. rig data from energy services firm Baker Hughes Co showed drillers a ninth increase in oil and gas rigs in 10 weeks.

There was talk of potential supply additions from Iran, Venezuela and the United Arab Emirates.

US delegation met with Venezuela leaders

A weekend visit to Venezuela by a high-level US delegation looking at energy security issues has local oil producers saying the country could send up to 400,000 b/d to US refineries if sanctions were lifted.

Ukraine’s farmers stalled, fueling fears of global food shortages

The Russian invasion of Ukraine threatens millions of tiny spring-time sprouts that should emerge from stalks of dormant winter wheat in the coming weeks. If the farmers can't feed those crops soon, far fewer of the so-called tillers will spout, jeopardizing a national wheat harvest on which millions in the developing world depend.

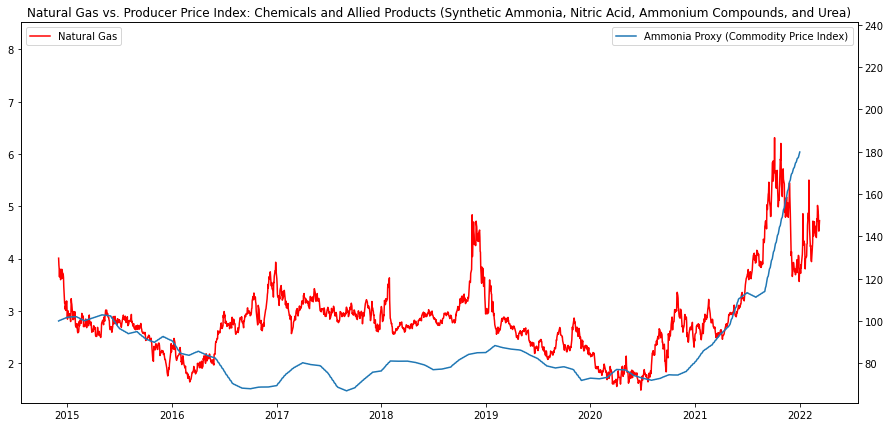

Ukrainian farmers - who produced a record grain crop last year - say they now are short of fertilizer, as well as pesticides and herbicides. And even if they had enough of those materials, they can’t get enough fuel to power their equipment, they add.

Drought in the western US is also limiting water availability for agriculture in 2022, spurring cuts to allocations in California and Arizona as extreme dryness continues into a third year. China agriculture minister says winter wheat condition could be worst in history.

Structural Fossil Fuel Shortage

UBS Joins Lenders Setting Fossil Fuel Emissions-Cutting Goals

UBS (UBSG.S) aims to cut its financing of fossil fuel emissions by more than two-thirds by 2030, Switzerland's biggest bank said on Friday, joining lenders setting targets for the first time this year. Credit Suisse also faces investor call to cut lending for fossil fuels.

More than 100 banks have pledged to reach net zero carbon emissions by 2050 and are under pressure to provide details on the deep shorter-term cuts needed if they are to have any chance of meeting their goal.

Analysis: Banks making a structural shift away from financing fossil fuel projects will reduce the available funding to the fossil fuel sector, resulting in higher interest rates for companies in this sector. This raises the required rate of return of new projects leading to less additions to the exploration and production pipeline.

As we have said before and we will reiterate again, until policy shifts to accommodate more exploration and production of fossil fuels during the transition to green energy, expect structural higher energy prices for the foreseeable future.

Oil industry to boost spending: Schlumberger

Oil and natural gas producers are ready to boost spending to capture the benefit of higher energy prices, although surging inflation and supply chain delays remain obstacles, according to oilfield services contractor Schlumberger. The pandemic has left the US shale sector in no position to add supply of its own as companies struggle to access people and equipment needed to drive growth.

Australian Floods

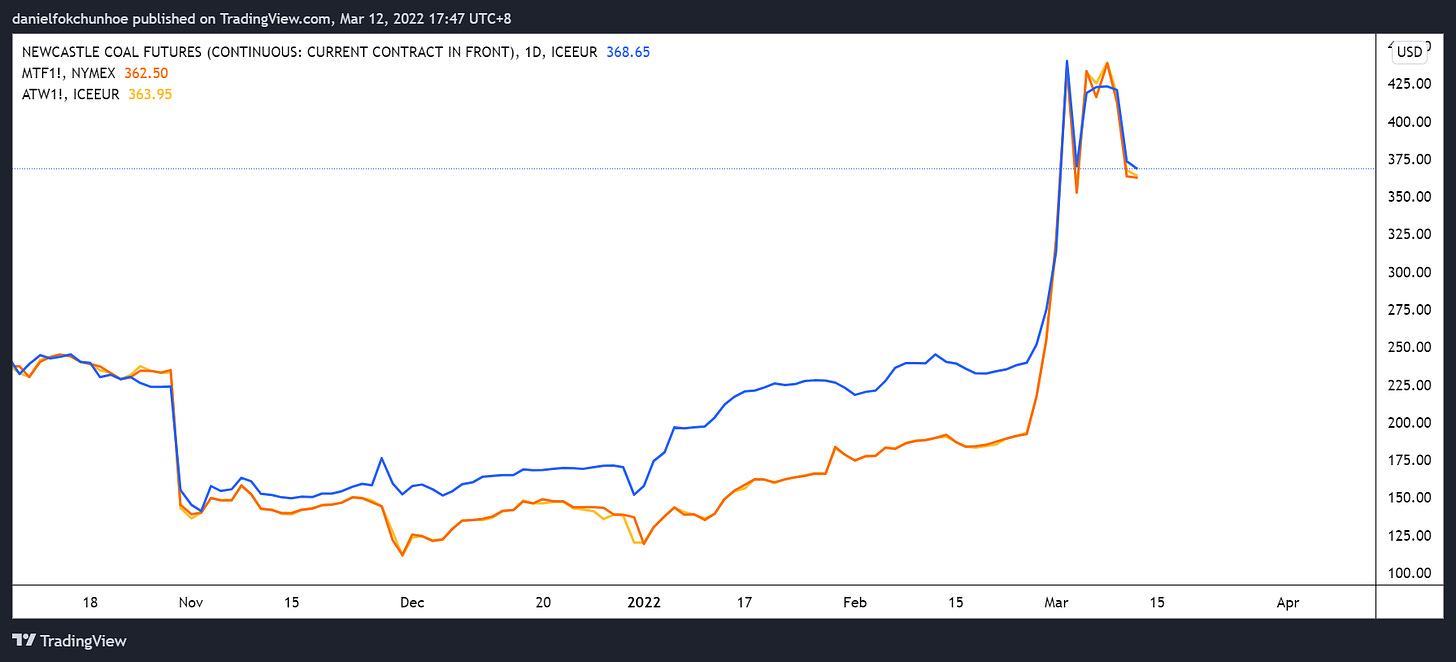

Australian Coal Export Recovery to Take Weeks

Mines in the key Hunter valley region of New South Wales (NSW) are waterlogged after heavy rainfall caused the evacuation of parts of the region earlier this week. Staff are returning to work after many were cut off by flooded roads or evacuated from flooded homes. But it will take a couple of weeks before mine operators can fully assess the damage.

Green Wave

Top Energy Companies Prepare to Launch New $1 bln Clean Tech Fund

A group of the world's top oil and gas companies are preparing to launch a new fund of over $1 billion to invest in new technologies focused on reducing greenhouse gas emissions from energy use, sources said on Thursday.

The Oil and Gas Climate Initiative (OGCI), which includes 12 of the world's largest oil and gas company including Exxon Mobil Corp (XOM.N), BP and Saudi Aramco (2222.SE), started in 2016 with an initial fund of $1 billion that has invested in several start-ups, including technologies to reduce emissions of methane, a potent greenhouse gas that escapes oil and gas infrastructure.

The group, which accounts for around 30% of the world's oil and gas production, is preparing to launch a second fund which is expected to be larger than the first one, the sources said.

Coal still at heart of China energy strategy after parliamentary gathering

China will make full use of coal as a vital part of its energy strategy, leaders and officials said during the nation's annual gathering of parliament this week, as it bids to balance economic stability with its longer-term climate goals.

Xi told a National People's Congress delegation from the top coal-producing region of Inner Mongolia that China, the world's biggest greenhouse gas emitter, was "rich in coal, poor in oil and short of gas" and "could not part from reality".

He said green transition was a process, and China could not simply "slam the brakes" on coal.